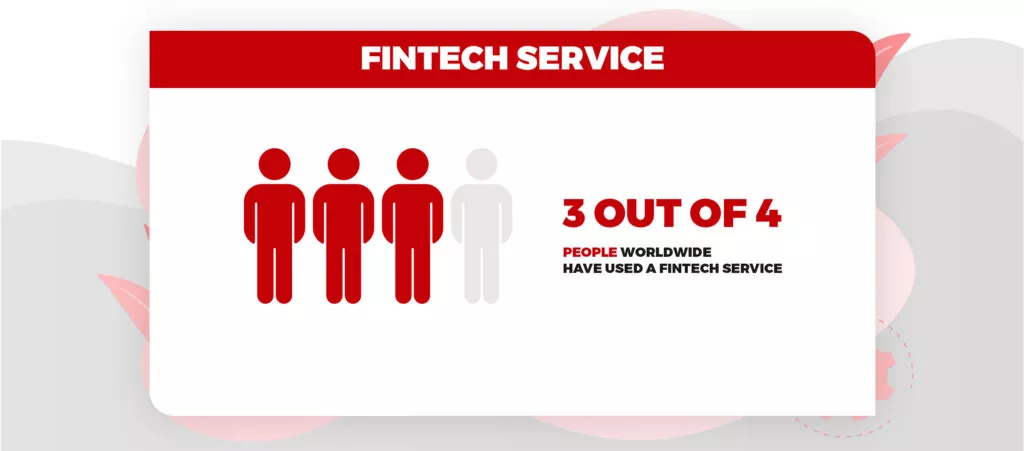

Fintech and cloud technology is a match made in heaven! What’s your say about this? Well, that’s true. It’s evident that cloud native services have turned into the new normal in the financial sector. In the fintech industry, cloud computing has emerged as a new trend that has greatly impacted the needs of the financial sector and given it a huge potential to expand. Fintech is predicted to have a $124.3 billion global market by the end of 2025, with a compound annual growth rate of 23.84%.

The need for established brands and fintech startups to offer their clients better services has grown as more personal and business transactions are conducted online. This includes quick, dependable, and secure services that are made feasible by cloud computing’s capacity to store and analyze massive amounts of critical data in a secure manner. Businesses may now store and share data at a cheap cost thanks to cloud computing, which also offers the advantages of safe storage, interoperability, scalability, and round-the-clock availability. Additionally, it gives the financial industry the ability to work with different platforms and apps and offer personalized experience for clients from around the world.

Let’s discuss how cloud adoption has been the game-changer for the Fintech Industry.

Table of Contents

Toggle

Table of Contents

Toggle

Image Source: Financesonline

What is Fintech?

Fintech refers to businesses that use technology to empower or automate their financial services. It is basically a blend of two terms – Finance and Technology.

Fintech companies integrate technologies (like AI, data science, and blockchain) into traditional financial sectors to make them more manageable, safer, and quicker. Fintech is among the fastest developing tech sectors, with companies advancing in almost every area of finance; from loans and payments to credit scoring and stock exchanging.

How is cloud adoption transforming the Global FinTech landscape?

Self-service applications

When the pandemic hit full power in mid-2020, there was a desperate requirement for remote self-service applications. As the emergency proceeds, and surprisingly after the pandemic closures, this need won’t vanish.

Both people and organizations need the ability to deal with their funds from remote. Self-service applications based on cloud technology assist organizations to deliver this innovation relatively at a quick speed.

Advanced-Data Management

The financial data is growing exponentially and managing it could have been difficult without cloud native services. Cloud technology permits FinTech firms to store and oversee information in a secured and trusted way. It additionally empowers organizations to take advantage of savvy strategies for lending, installments, and fraud detection.

There are impeccable benefits of cloud technology for FinTech and banks provided by some of the biggest cloud service providers like AWS, Alibaba cloud, etc. It gives an exceptionally secure platform, progressed engineering, customizable services empowering finance firms to give extraordinary client experience.

Potential for Innovation

Indeed, the cloud is an agile technology. Without this agility, probably the most recent advancements we’re finding in the finance business would not be imaginable. The cloud based technology assists financial organizations with getting their items to showcase quicker, meet the latest market trends and even change strategy to critical global events, for example, the Covid-19 pandemic. Its dexterity is perhaps the best advantage that the global fintech landscape can exploit in the coming years.

Flexibility and Scalability

Many organizations prefer the hybrid security environment, so the cloud works alongside the existing infrastructure. Many are working on a hybrid model to deploy cloud-based sandboxes to rapidly approve customers’ acknowledgment of new services without intruding on their current business. Cloud technology minimizes the risks of traditional infrastructure where redundancy and versatility are the principal business concerns.

Cloud’s scalability gives adaptability to the banks that empowers them to scan around a huge number of transactions happening each second, which upgrades the business’ capacity to fight monetary wrongdoing, similar to tax evasion.

Step-by-step guide for Cloud Migration

Zero CAPEX, decreased OPEX

On-premises data storage utilizes in-house hardware and software which can be of significant expense. Whereas cloud native storage solutions are claimed and overseen by third parties, subsequently, minimizing the initial capital expense and operational expense needed for server support.

Security and Privacy

Businesses have to deal with gazillions of data and can’t afford data leakage. A single data breach is enough to lose clients and their faith. Along with resource scalability, many of the tools needed to keep data secure are in-built within the cloud platforms. It enables firms to better secure data than what is available on the local servers.

Benefits of Cloud Computing Technology for Fintech Landscape

Adapting to any new technology is not easy. However, the cloud has a different story. The benefit of migrating to the cloud is more fruitful than not moving. Here are some benefits that your fintech business may reap with cloud computing technology –

- Easy access to on-demand processing capabilities

- Quicker continuous deliveries through cloud-based innovation

- Better customer experience through AI and ML

- Adaptability to scale up and incorporate additional applications and data sets

Best Practices For Cloud Adoption In Finance

Creating, storing, sharing, and handling the bulk of sensitive financial data make cloud migration in banking and fintech explicit. Here are what to consider –

- Encryption and access control – Discuss encryption strategies and techniques with your cloud service provider to choose the feasible ones that ensure the safety of the incoming and outgoing financial data.

- Compliance – Finance executives need to request that cloud service providers show consistent authentications of the cloud administration.

- Data isolation and management – Cloud services thrive on shared assets, however, financial firms might require a combo of shared asset benefits with the expanded security come to by information isolation.

- Disaster recuperation plan – The best cloud service providers generally have it set up, and it’s critical to get a detailed disaster recovery plan and guarantee your digital infrastructure allows all that.

Is cloud skills shortage limiting your business growth? Are you struggling to hire and retain experienced cloud experts? Not anymore! PeoplActive is the one-stop solution for you.

It is an IT consulting company that also specializes in staff augmentation services for cloud, cybersecurity, and DevOps roles. Leverage our curated pool of top-tier cloud engineers and accelerate your business growth. Let us know your requisition, our team will bring you the best fit cloud professionals ASAP. Hurry Up Now!